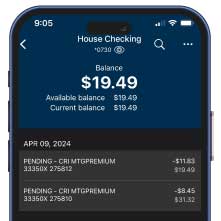

Mid Penn Bank Mobile Banking App

Mid Penn Bank’s secure and convenient mobile app provides access to your banking wherever you go.

Access Accounts on the Go

Mid Penn Bank’s mobile app provides access to your banking wherever you go! Simply download the app on your smartphone and log in the same as you do with online banking. Mid Penn Bank’s mobile app is a secure product intended to make banking more convenient for you!

Mobile app users have access to:

- Check account balance and transaction history

- Mobile Deposit

- Make transfers

- Pay bills

- Zelle® (person to person payments)

- Detailed account information

- Listing of Mid Penn locations

- Additionally, Apple® users can opt for Touch ID to quickly and securely access accounts!

Download the Mid Penn Bank app on your smartphone through the Apple® App Store or through Google Play™ for Android®.

A Mobile Banking App With Security Features You Can Trust

When central PA and NJ residents look for community banks with mobile apps, they want to know their information will remain private. We employ sophisticated authentication features and encryption to keep your money and personal data safe. You can:

- Set up alerts to stay informed about transactions of a certain size

- Enable push notifications that offer real-time updates

- Manage your savings and money market accounts from your phone

A mobile app will allow you to monitor your money closely. You can check your balance on your lunch break or ensure the electric company got your online bill payment as soon as you wake up in the morning. We designed our app to keep your private information secure because we care about our customers. As your community bank, we want to protect your interests and provide the support you need — we know that our reliability will increase your trust in us.

Mobile Deposit With Our Banking App

Bank your way with mobile deposit! With our mobile deposit service, you can deposit your checks safely and securely through our mobile app.

How to use mobile deposit:

- If you do not currently have the Mid Penn Bank app downloaded, you can download it on your smartphone through the Apple® App Store or through Google Play™ for Android®.

- When you log in and click the “Deposits” tab, you should see an icon called “Deposit Check.”

- You MUST endorse your check “For Mobile Deposit Only at Mid Penn Bank”. Any deposit without this exact endorsement will be rejected.

- Follow the prompts to deposit your check.

- When your deposited check status reflects as ACCEPTED, you should write “DEPOSITED” across the face, and store it safely for 30 days. You should destroy it (shred it) after 30 days.

Keep in mind:

- You can deposit as many checks as you’d like in one day, up to a $7,500 total limit.

- The “Check Deposit History” tab will show you the status of each deposited check. One of three statuses will appear: Pending, Accepted or Rejected.

- For next day availability, checks must be deposited by 4 p.m. (Availability may be delayed in certain situations as outlined in the “Terms and Conditions”).

Please see all rules and conditions as outlined in the “Terms and Conditions.”