How to Plan and Stick to a Wedding Budget

Recently engaged? Congratulations! Now comes the fun part of planning your wedding and getting ready to begin your new life together with your partner.

There are many logistical and creative aspects to planning a wedding. Perhaps the most critical one is developing – and sticking to – a budget. How much you end up spending on your wedding depends on an assortment of factors, from the size of your guest list to the style of the wedding. When your wedding takes place and how far in advance you get everything organized can also influence the overall cost.

Due to the COVID-19 pandemic, the average cost of a U.S. wedding in 2020 was $19,000 — much less than the national average of $28,000 in 2019. Despite the effect COVID-19 had on the price of a wedding ceremony and reception, wedding costs moving forward will likely be closer to the average costs in 2019. Of course, wedding prices vary greatly depending on a number of things, including location, venue, number of guests and your budget.

Couples in Pennsylvania spent an average of $35,900 on their weddings in 2019. While wedding prices may feel overwhelming to couples, planning a budget can be extremely helpful to save some money. From figuring out the logistics of your big day to setting and sticking to a budget, we’ve outlined what you can do to plan your wedding and get your new life as a married couple started without breaking the bank.

Budget Planning for Weddings: How to Get Organized and Stick to Your Wedding Budget

As you start financial planning for your wedding, there are a few logistical questions to answer before you jump into deciding what to wear and what cake to serve. Getting organized and determining what matters most to you and your partner will help you figure out where to splurge and where to find less expensive alternatives or wedding elements you can eliminate from your event entirely.

1. Write Your Guest List

When it comes to planning a wedding, people often wonder if they should set their budget or decide on a guest list first. Although it can seem like a good idea to figure out how you can spend on a wedding first, then fill in the guest list later, making your guest list first can often be the better option.

The size of your guest list plays a considerable role in determining your overall budget. Weddings with fewer than 50 guests typically cost between $9,000 and $16,000. Weddings with 100 to 200 guests typically cost between $21,000 and $35,000. The largest of weddings, with more than 300 attendees, often cost over $60,000.

Knowing the number of guests you want to have at your wedding can help you determine your total wedding budget.

Part of making the guest list involves deciding who gets to invite people and how many people they get to add to the list. One wedding tradition states that the engaged couple gets to invite half of the guests, and the parents on each side get to invite a quarter of the guests each. How you divide up your list can vary, though, depending on who is covering the costs of your wedding. Depending on who is covering the costs of your wedding, how you divide your guest list may vary. If you are paying for the entire event on your own, you might decide that it’s only fair to invite more than half of the guests.

No matter how you end up splitting the guest list, it’s a good idea to set firm limits. If you decide that each set of parents can invite 20 people, be strict with that number to avoid them adding guests — even one or two — at the last minute.

Once you’ve decided how to divide up the guest list, it’s time to start thinking about who is going to be on it. Start with your families. The size of your family will factor into the size of the guest list. Large families will bump up the total number of guests pretty quickly! Decide whether or not you’ll invite your entire families, including aunts and uncles, cousins and second cousins or if you’ll limit the list to immediate family members only. If you are hoping to keep the guest count lower, it’s often a good idea to keep the event to immediate family only, such as siblings, parents and grandparents.

To invite children or not is another important consideration when planning your guest list. If there are a lot of children in your family and social circle, making your ceremony and reception “adults only” allows you to keep the guest list under control.

Sometimes it can be difficult to decide whether or not to include a person on your guest list. If you find yourself having this debate, answer the following questions to help you decide who to include or not:

- Do both you and your partner know the person?

- Have you spoken to the person in the past few years? If not, are they related to one of you?

- Did you go to this person’s wedding? If so, when?

Once you’ve got a guest list number, you can start to focus on the other aspects of wedding planning, such as your budget and who will pay for what.

2. Decide Who’s Paying for What

Traditionally, it has been the responsibility of the bride’s family to pay for the wedding ceremony and reception. Now, other arrangements are becoming more common — the couple may pay for all or part of the wedding, or the groom’s family chips in to help with the costs, as well.

Whether you and your partner are going to cover the entire cost of the event, are splitting it equally with one or both sets of parents or are accepting other financial help, it’s important to figure out who is contributing to your big day and how much each party is chipping in. Just as knowing how many people you’re going to invite will help you set your budget, knowing who is contributing can influence your wedding spending plan.

3. Set Your Budget

You know how many people you’d like to invite, and you have an idea of who’s contributing to the big event. Now it’s time to run the numbers and determine how much you can comfortably spend on your wedding.

When you plan a wedding budget, there are three things to examine:

- How much you and your partner have saved for a wedding

- The amount of disposable income you both have which you can direct to your wedding

- How much your respective families have offered to contribute

Another essential thing to consider is whether or not you are willing to accrue some debt to pay for your wedding. Loans are good options for some couples, while others prefer to use the money they currently have in the bank or that they will save in the months leading up to the wedding.

Other couples might decide to put a few wedding costs on their credit cards to pay off later or to charge all of their expenses. If you do choose to use a credit card to pay for your wedding, it’s a good idea to think about how doing so will affect your married life both immediately after the event and in the years to come. Taking out a personal loan is also an option.

4. Divide up Wedding Costs

Part of making your wedding budget involves allocating specific amounts to specific categories. The bulk of your wedding costs will most likely be centered on the reception itself. Usually, the reception accounts for up to 50 percent of the total cost of the wedding. The ceremony itself usually makes up around 3 percent of the total cost while wedding attire can make up to 10 percent of the total costs.

It’s common for the reception to account for roughly 50% of the total cost of the wedding because this includes the venue, caterers, rentals and dining tables and chairs. While every couple’s wedding budget is different, consider the following breakdown to get started:

- 12% for a photographer

- 9% for wedding attire and hair and makeup

- 8% for ceremony and reception decorations

- 7% for reception entertainment

- 3% for a wedding planner

- 3% for stationery

- 2% for an officiant

- 2% for transportation

- 2% for wedding bands

- 2% for wedding favors

Looking at the average costs for particular aspects of a wedding can give you an idea of what you can expect to spend on each part. Knowing the average prices can also help you decide if a particular component, such as a DJ or live band, is something you must have at your wedding.

Based on national averages in 2019, here are the average wedding costs of common wedding elements:

- The dress: $1,600

- Renting tuxedos: $280

- Florist: $2,000

- DJ: $1,200

- Live band: $3,700

- Wedding favors: $400

- Photographer: $2,400

- Wedding officiant: $280

- Catering for 100 guests: $7,000

- Wedding cake: $500

- Venue: $10,500

- Rings: $5,900

After you’ve made a list of all the things you want and need for your wedding and their anticipated cost, it’s a good idea to give yourself a bit of a safety net. Add an extra 5%-10% to the total cost of your wedding as a cushion. That way, if things do end up costing more than expected, you won’t go over budget.

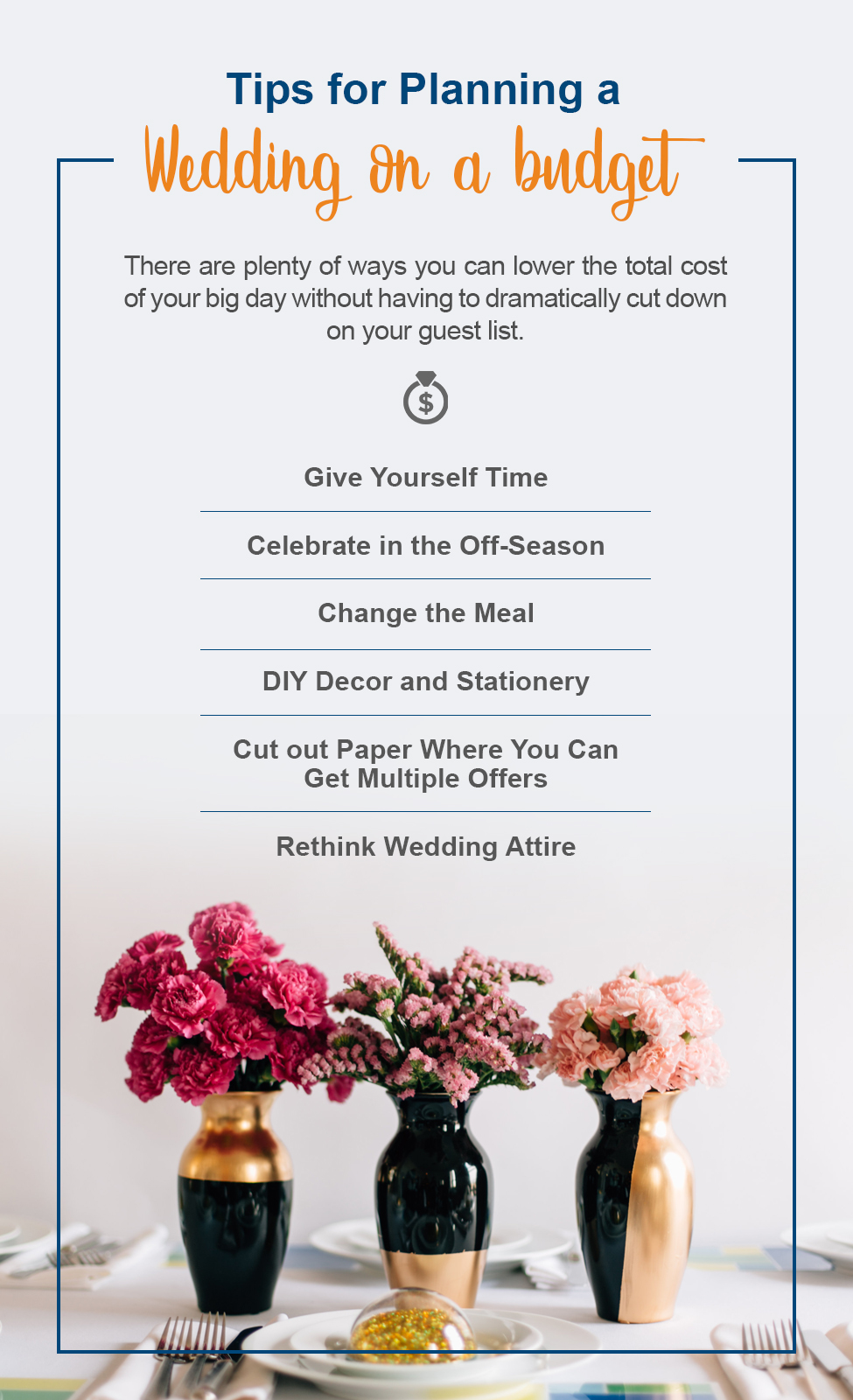

Tips for Planning a Wedding on a Budget

After running the numbers and comparing them to your target budget, you might realize that your ideal wedding costs more than you can afford to spend. Don’t worry — there are plenty of ways you can lower the total cost of your big day without having to dramatically cut down on your guest list.

1. Give Yourself Time

After getting engaged, you might want to get married as soon as possible. Depending on when your engagement took place, that might not work in your favor. If you are hoping to get married in the middle of the high wedding season or near the start of it, trying to plan a wedding that takes place before the season is over is most likely going to cost you.

It’s more difficult to find venues, caterers and musicians or DJs in the middle of the prime season. They are likely to be booked or to charge you a higher fee for in exchange for the limited notice.

If you can wait, put your wedding off for at least a year. Planning for a date further in the future means you’re likely to have more options available to you. You’re also going to be in a better position for negotiating with vendors.

2. Celebrate in the Offseason

May through October tends to be prime wedding season, and October has been the most popular month for the past few years. The least popular wedding month is January, most likely due to a combination of chilly temperatures and the possibility of winter weather in many areas. If you’re looking to trim the cost of your wedding, it can be worthwhile to consider holding it during a less popular month.

Another benefit of having your wedding during the offseason is that your guests are less likely to have other weddings on their calendar during those months, and vendors are less likely to be fully booked.

3. Change the Meal

Although serving dinner at a wedding reception is the traditional choice, it’s not your only option. Depending on when you hold the ceremony, you can serve lunch, brunch or even light refreshments instead of a full, sit-down evening meal. Lunch and brunch tend to cost less than a typical wedding dinner, helping to reduce the cost of your food bill for the event. Additionally, serving food buffet style is often less expensive than seated, served dinners with multiple courses.

4. Decor and Stationery

If you or anyone in your wedding party is crafty, doing some of the decorating or invitation creation yourself can help you save on wedding decorations and stationery costs. Putting together decorations for your reception can be a fun way to bond with your wedding party, too. You can host a small gathering during which you work together on making the centerpieces and table cards for the big day. Also, consider how many decorations you want. Going a more minimal route can save money, too.

5. Cut Out Paper Where You Can

Although you’ll most likely want to send guests a paper invitation and mail out paper thank-you cards, you don’t need to send people a physical invitation or reminder for every event associated with your wedding. You can send save-the-date reminders via email and use e-invitations to invite guests to events such as the rehearsal dinner or a post-wedding brunch.

6. Get Multiple Offers

You might fall in love with a venue the minute you walk through its doors, but you don’t necessarily want to commit to that venue without looking at a few others. Shopping around gives you a good idea of what the price range is for various wedding services in your area. If you notice that one venue is considerably cheaper than another, but you want to go with the more expensive place, knowing the price range can give you a stronger hand when negotiating.

7. Rethink Wedding Attire

While it’s traditional for brides to wear white dresses and grooms to wear tuxedos on their big day, no hard and fast rule says you must do those things. You’re likely to reduce costs in this area significantly if you think beyond tradition. The groom and groomsmen can swap tuxedos for suits, which they are more likely to wear again. These days, there are many options and retailers for bridal attire that offer alternatives to purchasing a new, big and expensive wedding gown from a bridal store.

Start Saving for Your Wedding Today

Whether you’ve recently gotten engaged or know that a proposal is forthcoming, setting up a savings account for wedding expenses can help you see how much you have to spend and help you avoid going over budget on expenses. Our list of featured rates can help you determine which account is right for you. Mid Penn Bank offers savings accounts, including our money market accounts, to residents of Central Pennsylvania that are designed to help you reach your goals and plan for major life events, such as a wedding. To learn more about our savings accounts, get in touch with us today.

Share:

Disclosures

The material on this site was created for educational purposes. It is not intended to be and should not be treated as legal, tax, investment, accounting, or other professional advice.

Securities and Insurance Products:

NOT A DEPOSIT | NOT FDIC INSURED | NOT BANK GUARANTEED | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | MAY LOSE VALUE