Don’t Fall for the Voice: How to Spot and Stop Phone-Based Social Engineering Attacks

Your phone rings, displaying your bank’s name on the caller ID. The caller’s voice is professional and urgent, stating “We’ve observed suspicious activity on your account and must verify your details immediately to stop unauthorized access.” Although it appears genuine, it may actually be a sophisticated social engineering scam designed to steal your funds and compromise your personal information.

Phone-based social engineering, often referred to as “vishing” (voice phishing), has become one of the most effective tools in a cybercriminal’s arsenal. Unlike email phishing, which many people have learned to recognize, phone calls feel more personal and urgent, increasing the likelihood that a target will comply with requests for sensitive information.

Modern vishing attacks rely on a combination of technology and psychology to create convincing deceptions, including:

- Technical Manipulation: Attackers use caller ID spoofing to make their calls look as if they are from trusted organizations like banks, government agencies, or your employer’s IT department. Some even use AI-generated voices or real-time voice modulation to sound more authoritative or to mimic the voices of people they know.

- Psychological Pressure: Scammers exploit strong psychological triggers to bypass your rational thinking. They create artificial urgency (“Your account will be closed in one hour”), invoke authority (“This is the IRS calling about tax violations”), or offer help (“We’re calling to resolve a security issue for you”). They may also use personal information gathered from social media or data breaches to make their story more convincing.

- Scripted Deception: These aren’t random calls, they’re carefully orchestrated campaigns. Attackers often coordinate across multiple channels, sending emails or texts before calling to establish credibility. They use detailed scripts designed to guide you toward revealing passwords, answering security questions, or providing remote access to your devices.

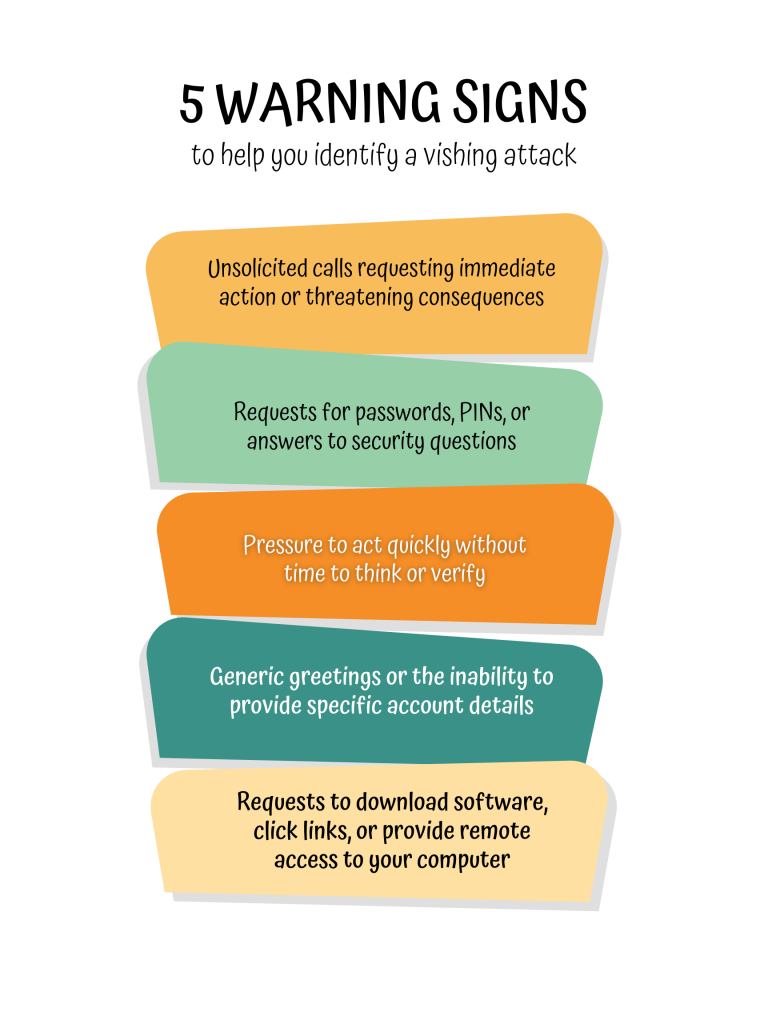

There are several warning signs that can help you identify a potential vishing attack, including:

There are several warning signs that can help you identify a potential vishing attack, including:

- Unsolicited calls requesting immediate action or threatening consequences

- Requests for passwords, PINs, or answers to security questions over the phone

- Pressure to act quickly without time to think or verify

- Generic greetings or an inability to provide specific account details they should already have

- Requests to download software, click links, or provide remote access to your computer

The most effective defense against vishing attacks combines healthy skepticism with verification protocols. To protect yourself, remember to:

- Never provide sensitive information to unsolicited callers, regardless of how legitimate they sound or what consequences they claim or threaten. If someone claims to be from your bank, insurance company, or IT department, hang up and call them back using a number you find independently—not one they provide.

- Implement verification procedures in your personal and professional life. Many organizations now require multiple forms of authentication for sensitive requests, making it harder for attackers to succeed with a single phone call.

- Stay informed and train others. Share knowledge about these attacks with family, friends, and colleagues. Regular awareness training and simulated attacks can help people recognize manipulation tactics in real-world scenarios.

Mid Penn Bank will never ask for your full passwords or sensitive security information over an unsolicited phone call. When in doubt, hang up and verify independently. A few minutes of caution can prevent months of financial and personal recovery from a successful attack.

Share:

Disclosures

The material on this site was created for educational purposes. It is not intended to be and should not be treated as legal, tax, investment, accounting, or other professional advice.

Securities and Insurance Products:

NOT A DEPOSIT | NOT FDIC INSURED | NOT BANK GUARANTEED | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | MAY LOSE VALUE